There is a special kind of silence that comes with debt:

- The silence when the salary comes and disappears in EMIs.

- The silence when someone calls from an unknown number and your heart skips a beat.

- The silence when you are adding items to your cart thinking, “I deserve this,” and a tiny voice inside whispers, “But how will you pay later?”

For many women, this silence is louder than any financial statement. We don’t think of debt only as interest and EMI. We think of it as “Am I responsible?”, “Am I failing?”, “Am I a burden?”. At the same time, loans are often the only way to study further, buy a house, support our families or start a business. So the question is not:

“Are loans good or bad?”

The real question is:

“Am I using debt as a tool to build my life, or am I slowly giving away my peace?”

This is what Smart Woman, Smart Debt really means.

It does not mean “never borrow”. It means learning to see exactly when a loan is helping you rise, and when it is quietly pulling you down.

Why Debt Often Feels Heavier for Women

Even before we hold our first ATM card, many of us have already absorbed messages about money and loans.

- We’ve seen mothers silently worry about EMIs but never talk openly.

- We’ve seen fathers or husbands handle “big” financial decisions while women manage daily expenses.

- We’ve heard lines like, “You don’t worry about money, we’ll take care of it,” or “Sign here, it’s just a formality.”

So when we, as women, start earning or taking decisions:

- We may feel underconfident asking questions

- We may feel guilty if we “mess up” with money

- We may agree to loans we don’t fully understand, just to avoid conflict

On top of that, women’s lives often include career breaks, part-time phases, and unpaid care work. That makes any long-term EMI feel riskier. We know that if something happens, it might take us longer to bounce back than others. This combination of social conditioning and real-life vulnerability makes debt feel heavier for women , even when the amount is the same.

Key Takeaway

- Debt is not just numbers for women, it’s identity and self-worth.

- Many of us were trained to be “good girls who don’t ask questions” about loans.

- To become a “Smart Woman with Smart Debt”, we first have to admit how much emotional weight debt carries for us.

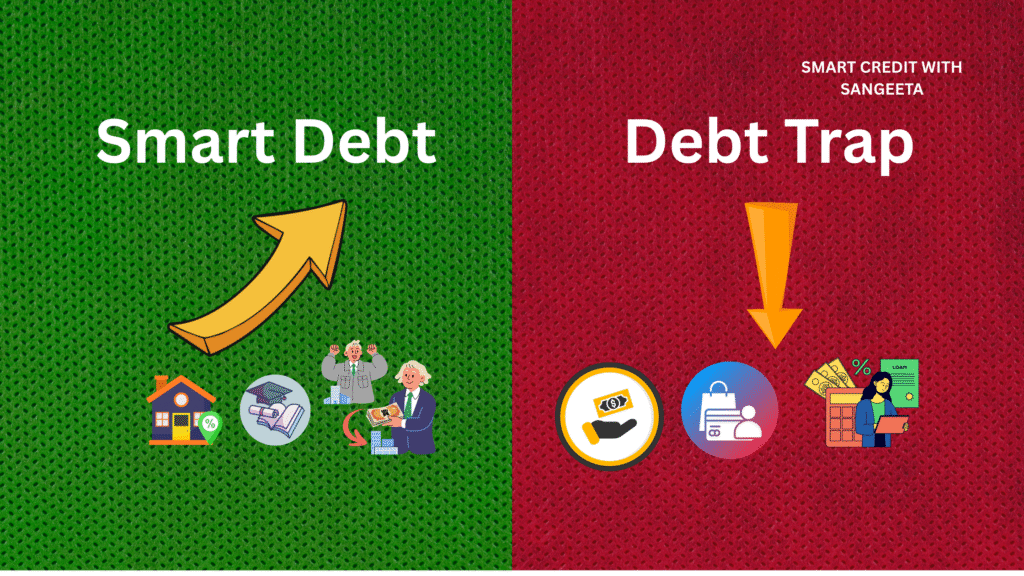

What “Smart Debt” Really Means (It’s Not Just Good vs Bad)

When people talk about “good debt” and “bad debt”, it often sounds very technical. Home loan is good, credit card is bad, education loan is good, personal loan is bad. Real life is even more complex than that.

- A home loan can become a burden if the EMI is beyond your capacity.

- A personal loan can be powerful if it funds a skill that changes your career.

- A credit card can be a useful tool if you clear it in full every month.

- An education loan can become lifetime stress if the course had no real value.

So instead of only thinking “good vs bad debt”, try this lens:

Smart debt is any borrowing that:

- Serves a clear purpose in your life

- Has a realistic repayment plan

- Does not steal your sleep or basic security

Unsuitable/ bad debt is any borrowing that:

- Comes from comparison, pressure or panic

- You don’t fully understand

- Makes you feel tight, scared or dependent month after month

“Smart Woman, Smart Debt” doesn’t mean you become perfect with money overnight. It means you begin to ask better questions before taking or continuing any loan.

Key Takeaway

- Smart debt is about alignment and clarity, not just interest rates.

- A “good” product can still be a bad decision if it doesn’t fit your life.

- You don’t need to become a finance expert; you just need to become honest and awake about your reasons.

When a Loan Is Actually an Act of Courage

Let’s talk about those moments when taking a loan is not a weakness, but a quiet act of courage.

a) Investing in Education or Skills That Truly Improve Your Future

If you are taking a loan to study further, switch careers, or learn a specialised skill that has a real demand in the market, you are not just borrowing money. You are borrowing time and opportunity from your future self, with a plan to pay her back with interest.

Let’s take an example:

- A woman who worked in a low-paying admin job but takes an education loan to move into finance or tech.

- A homemaker who invests in a solid skill program that allows her to freelance or consult from home.

This kind of debt makes sense when:

- You have researched the course, not just fallen for marketing.

- You see real people succeeding after doing it.

- You can see a path: “If I complete this, I can earn roughly this much and repay in these many years.”

Here, the loan is not buying “status”. It is buying you possibility.

b) Growing a Business That Already Has Life in It

Business loans are not always monsters. For a woman entrepreneur, they can be a ladder. Just think of a home baker who is booked out every weekend, or a consultant who has more clients than hours. At some point, “jugaad” is not enough, we all agree with that. To grow, you need:

- A better machine

- A helper

- More stock

- A small office or studio

If your business already has clear demand and basic profit, then a carefully thought-out loan can help you move from:

“I am managing somehow”

to

“I am building something solid.”

The key is truthfully knowing your numbers: What comes in each month, what goes out, and how much profit is left. If a loan will help you serve more customers and increase profit after paying EMI, it can be called smart debt.

c) Building a Safe Home Within Your Means

For many women, owning a home is not about showing off; it’s about feeling safe.

A home loan can be wise if:

- The EMI fits comfortably within your household income

- You are not compromising on health, education, and basic living expenses

- You’re choosing a house that you can actually live in and maintain, not just a fancy address

It’s okay if the home is simple. Safety is also a kind of luxury.

d) Cleaning Up Toxic Debt with a Smarter Structure

If you’re already stuck with:

- High-interest credit cards

- Multiple small app loans

- Random EMIs on purchases you barely remember

there are cases where taking one structured, lower-interest loan to close all this can be a smart move. The courage here is not in borrowing again. The courage is in facing your numbers honestly, accepting past mistakes, and reorganising your debt to protect your future. But this only works if you also change the behaviour that created the mess. Without that, even the smartest consolidation is just a pause before the next storm.

e) Handling Genuine Emergencies

Finally, sometimes life doesn’t give you time to save first. When there is a real medical emergency, a legal obligation, or a serious family crisis, a loan can be the difference between having options and feeling totally helpless.

In those moments, “smart” simply means:

- You choose the least exploitative option

- You understand the terms before you sign

- You commit to rebuilding after the crisis, step by step

No guilt. Just responsibility, taken with open eyes.

Key Takeaway

- Some loans are not failures; they are bridges to a better future.

- Smart debt usually connects to education, business, home, or genuine emergencies and is supported by honest numbers.

- The question is: “Is this loan helping me expand my life or just delaying a discomfort?”

When Debt Quietly Turns into a Trap

Now the harder side: the patterns where debt slowly starts owning us.

a) Funding Lifestyle and Comparison, Not Real Needs

It starts small.

- A phone on EMI because “everyone has it”.

- A holiday on a credit card because “I need a break”.

- Festival shopping you can’t afford because “what will people say”.

None of these individually look dangerous. But together, they create a cycle:

- Swipe now → feel good → bill comes → feel tight → borrow again.

When you use loans to maintain a lifestyle that your income alone cannot support, debt stops being a tool and becomes a mask. It hides the truth that something in your income–expense balance needs to change.

b) Trying to Save a Business That Has No Clear financials

I have seen this many times as a banker: A business is not doing well. Sales are uneven, costs are unclear, profits are guesswork. Instead of fixing the model, the owner takes more loans, hoping extra money will magically repair everything. For women running small businesses, this is dangerous. If your business model is weak or confused, more debt multiplies the confusion.

Before borrowing for business, ask:

- Do I actually know how much I earn and how much I spend every month?

- Do I know why customers choose me or don’t choose me?

- Is my pricing fair and sustainable?

If the answer is “I don’t really know”, the priority is clarity, not credit.

c) Taking Risks in Your Name for Someone Else’s Dream

This one is especially for women. Sometimes we take loans:

- For a partner’s business

- For a brother’s project

- For a friend in crisis

- Or to help someone who “just needs your name on the form”

It’s beautiful to be supportive. But there is a clear difference between support and self-abandonment. If the loan is in your name, then:

- Your CIBIL is at stake

- Your phone will ring if EMIs are missed

- Your peace and future borrowing capacity are affected

Before signing, ask yourself honestly:

“If things go wrong, am I genuinely ready and able to repay this myself?”

If the answer is no, love does not require you to destroy your financial safety.

d) Signing Papers You Don’t Understand

Sometimes the trap is not emotional; it’s informational. Maybe the product is not evil. But if you:

- Don’t know the interest rate

- Don’t know how many years you will be paying

- Don’t know the total amount you’ll end up repaying

- Don’t know what happens if you miss 1–2 EMIs

- Don’t know if your gold, house or fixed deposits are being pledged

then you are walking into a complex commitment with closed eyes.

As a smart woman, you don’t need to know every technical term. You just need to slow down enough to say:

“Explain this to me clearly. I’ll read it and then decide.”

Any person or institution that is offended by your questions is not someone you should be taking a loan from.

e) Making Debt Decisions on Your Worst Emotional Days

On days when we feel lonely, rejected, angry, scared or “behind in life”, we are at our weakest for financial decisions.

Maybe you:

- Overspend on shopping to feel better

- Invest in something risky out of FOMO

- Take a random course loan because you feel your life is stuck

Money choices made in emotional storms are often regretted in calm weather.

A simple rule you can adopt:

“If today is a high-emotion day, I will not sign any loan documents.”

Key Takeaway

- Debt becomes a trap when it is used to avoid reality like lifestyle, business truth, relationship boundaries, or emotional pain.

- The smartest thing you can sometimes do is delay the decision until you are clear-headed.

Women-Specific Patterns to Watch Out For

There are a few debt patterns that hit women particularly hard.

a) Co-signing “Just for Formality”

When you sign as a co-applicant or guarantor, you are not doing “formality”. You are sharing full responsibility. If the main borrower doesn’t pay, the lender will come to you. Your CIBIL will reflect that default. Your future job or loan might get affected. From now on, treat your signature seriously. Saying, “I need to understand this first” is not being difficult. It is being smart.

b) Pledging Your Gold Without Being Fully Involved

Gold is often the only asset a woman feels is “hers”. But in many households, her gold gets pledged repeatedly for business, family functions or short-term needs. If gold must be used, you have the right to know:

- How much is being pledged

- At what rate and terms

- For what exact purpose

- When and how it will be repaid

Your jewellery is not just metal. It is part of your financial safety net. You deserve transparency and a say in how it’s used.

c) Falling for Instant App Loans and Salary Advances

When money is tight, instant loan apps feel like a lifeline. Approval is quick, document requirements are low, and the amount appears in your account in minutes. But behind this convenience are:

- Very high interest rates

- Aggressive recovery methods

- Privacy risks

If you’re already feeling small and stuck, harassment over small overdue amounts can be deeply damaging for your mental health. Sometimes the bravest choice is to say:

“I will face my situation honestly and look for slower, safer solutions not quick fixes.”

Key Takeaway

- Your signature, your gold, your CIBIL are not small things.

- Treat them as part of your confidence and protection, not as tools to be handed over without questions.

Seven Questions Every Smart Woman Can Ask Before Any Loan

Let’s bring everything into a simple, practical reflection. Next time when you are about to take a loan or you are wondering whether to continue with an existing one, just sit with these questions:

- What exactly is this loan creating for me?

An asset, a skill, a business, a home, security or just a moment of lifestyle or relief? - Can I comfortably live and still save a little after paying this EMI every month?

If paying the loan means cutting into medicine, healthy food, or children’s basics, the cost is too high. - Do I have any cushion if something goes wrong?

Even 1–3 months of basic expenses saved can make a huge difference. - Do I fully understand the numbers?

Interest rate, total amount payable, tenure, penalties, collateral. If not, pause. - Is this my goal or someone else’s dream on my head?

Be honest about who benefits most and who carries the risk. - If my income dropped by 20–30%, could I still manage?

Life doesn’t always go as per Excel sheet. Build some realism into your planning. - Is there a simpler, slower, no-loan way to reach the same goal?

Sometimes waiting one more year and saving is not failure; it’s wisdom.

You don’t need to tick every box perfectly. But if your answers scare you, that fear is not weakness it is intuition asking you to rethink.

If You’re Already in Deep Debt, This Is Not the End of Your Story

Maybe as you read this, you feel a tightness in your chest. You’re thinking:

- “I already made all the mistakes she’s describing.”

- “I’m already stuck.”

- “I wish I had learned this earlier.”

Let me tell u this: You are not the only one and you are not beyond repair. You can start from where you are. Today. With:

- One honest page listing all your loans

- One decision to stop adding fresh debt for non-essentials

- One small plan to increase income or reduce expense

- One honest conversation with someone you trust

“Smart Woman, Smart Debt” is not a label you either have or don’t have. It’s a practice. Every time you say, “Let me think this through,” you are already becoming that woman.

You Deserve to Be Financially Calm and Clear

You deserve a life where:

- Phone calls don’t scare you

- Bank statements don’t shame you

- Loans, if you have them, are there for reasons you deeply understand

Not perfect. Not always easy. But honest, intentional, and respectful towards your future self.

A smart woman is not the one who never borrows.

She is the one who can look at a loan and say,

“I know exactly why I’m taking this – or why I’m not.”

If this blog spoke to you, don’t keep it just in your bookmarks. Share it with a sister, a friend, a colleague, a client anyone who is silently carrying the weight of EMIs and decisions she never really got to make. And slowly, one honest conversation at a time, we build a world of Smart Women with Smart Debt women who use money as a tool, not a weapon against themselves.

Frequently Asked Questions: Smart Woman, Smart Debt

1. Is all debt bad? Should a smart woman avoid loans completely?

No. All debt is not bad. A smart woman doesn’t run away from loans, she understands them. Debt taken for education, a working business, a well-planned home or a genuine emergency can be useful when there is a clear repayment plan. The real problem is debt taken out of pressure, comparison or confusion.

2. How do I know if a loan is “good” for me?

Ask yourself three simple questions:

- What is this loan creating an asset, skill, income or just lifestyle?

- After EMI, can I still live with dignity and save something regularly?

- If my income drops by 20–30%, can I still manage this EMI?

If your honest answers scare you, the loan might not be right for you at this time.

3. I already have multiple loans and feel trapped. Where do I start?

Start with clarity, not shame. Take one page and list all your debts – lender, type, EMI, approximate interest and outstanding amount. Identify the highest-interest and smallest-balance loans first. Focus on closing one at a time, stop adding new debt for non-essentials, and slowly rebuild an emergency fund. You don’t have to fix everything in one month; you just have to stop ignoring it.

4. Is taking a personal loan always a bad idea?

Not always. A personal loan can be sensible if:

- the interest rate is reasonable,

- you clearly know why you need it, and

- you have a realistic repayment plan from reliable income.

It becomes dangerous when it is used repeatedly for lifestyle upgrades, to pay old EMIs, or to bail out others without any structure.

5. Should I ever take a loan in my name for my husband/partner/family?

You can, but you must understand the risk. If the loan is in your name (or you are co-applicant/guarantor), your CIBIL, your peace, and your future borrowing capacity are on the line. Before saying yes, ask: “If things go wrong, can I repay this alone? And do I have equal say in how this money is used?” Love and support don’t require you to blindly risk your entire financial identity.

6. How can women avoid emotional mistakes with debt?

Create a simple personal rule: “On my worst emotional days, I don’t take loan decisions.” Don’t sign anything when you are very angry, hurt, scared or feeling “behind in life”. Wait a few days, calm down, talk to someone neutral, and then review the decision with a clear mind. Most painful debt stories begin with an emotional high or low.

7. What’s the difference between using a credit card wisely and falling into a trap?

Using a credit card wisely means you:

- pay the full amount by due date,

- know your monthly limit, and

- use it for convenience, not to stretch your lifestyle.

It becomes a trap when you pay only minimum due, roll over balances, and keep swiping without a clear monthly budget. The card itself is not the enemy; the lack of discipline is.

8. When is a home loan considered “smart debt” for a woman?

A home loan is usually considered smart when:

- the EMI is within 30–35% of your stable family income,

- you still have money for health, education, basic living and some savings, and

- the house is for your security, not just social status.

If paying the EMI means constant anxiety and cutting essentials, the house may be emotionally right but financially too heavy for now.

9. Can consolidating loans into one big loan help me?

Consolidation can help if you’re stuck with many high-interest EMIs and you replace them with one lower-interest, structured loan. It simplifies tracking and can reduce total interest. But it only works if you also close the old credit lines and stop taking new debt for non-essentials. Otherwise, you end up with the new big loan plus fresh small loans – a worse situation.

10. How can I become “smart with debt” if I’ve always been scared of money topics?

Start small and gentle.

- Read one blog, listen to one podcast episode or watch one video each week on money and credit.

- Keep a simple monthly money diary – income, expenses, EMIs, savings.

- Ask questions without shame, even if they feel “basic”.

Over time, understanding reduces fear. A smart woman with smart debt is simply a woman who is willing to learn, ask, and choose slowly instead of rushing under pressure.